Do you ever feel like your money is just slipping through your fingers? As soon as you get it, you spend it. And you hardly even know what you’re spending it on. No matter your financial goals, they have one solution when you’re first getting started: the no-spend month.

During this time, you’ll save money, of course. But you’ll also learn to appreciate what you already have and be more mindful about how you spend your time and energy. And it won’t feel like deprivation at all because the most important things to us will still be there waiting for us after our thirty days are up. We can always go back to them if we want to.

Let’s dive into how to do your own no-spend month and make it a success.

What is a no-spend month anyway?

A no-spend month is a period of one month in which you ban spending. It’s something you decide to do yourself (for various reasons).

You are no longer allowed to spend money on anything that is not a necessity.

Simple! Not easy, but simple.

What do we mean by NO spending? Like… at all?

Obviously, the bank will not be amused when you send in your mortgage check because you’re doing a fun little challenge. So you’ll budget for the following:

- mortgage or rent

- utilities

- gas

- school and activity expenses for kids

- a set amount for food

Once you get more experienced with a no-spend challenge, you can relax the rules. You can give yourself a small amount of money to spend on luxuries. You can go out to eat once.

But for your first challenge, be strict with yourself. Only spend money on what’s 100% necessary.

Watch

Why would we do this?

So many reasons. Half of Americans spend more than they make. Most of us have credit card debt, student loans, or just terrible spending habits that leave us with no extra money.

Even if your personal financial situation is great, a no-spend challenge is still beneficial. It goes beyond just money.

Separating essentials from luxuries

When you look at your budget on paper, everything seems important. Netflix? Of course, you need it. That ice cream maker you bought last month? Totally essential, and it was just a one-time thing.

But when you cut out EVERYTHING, you realize how little you actually need.

This is where the no-spend month shines. It’s an excellent chance to reset your budget and see if your spending habits are out of line with your goals.

Saving money for a big purchase

At the end of your no-spend month, you won’t just have a new perspective. You’ll have a lot of money that you’ve saved.

Use that money to buy a big-ticket item, plan a vacation, or tuck it away in savings.

You’ll feel great, no matter how you use the extra cash.

Making nice things feel special again

When you return to “normal life,” all those things you gave up feel so special.

When you’ve spent a no-spend month without them, everything feels new and shiny.

Restaurants, evenings out, magazines grabbed at the grocery store… they’ll no longer feel like an entitlement but rather a luxury.

Finding support: don’t go it alone

The no-spend month is much easier when you can find other people doing it. Don’t even think of trying to do this without your spouse; it’s basically impossible.

If you can’t find any real-life support, look for a Facebook group of no-spenders. You’ll be able to cheer each other on and ask questions.

Finding no-spend buddies in real life, whether they’re friends or family members, is a great idea.

Preparing for your no-spend month

So you think no spend month sounds like a great idea. Maybe you’ve even decided to do it for real and have no plans of cheating.

But before we go on, a reality check…a no-spend month is hard. It’s not impossible, but it takes planning to be successful.

Here’s what you need to do before you start:

- Make a list of the things you have to spend money on (rent, debt payments, utilities)

- Decide on your food budget. Make this as low as you think is possible to get by, but be realistic about the fact that you’ll probably need to buy some groceries.

- Wrap up any subscriptions or memberships you no longer use.

- -Figure out how you’ll entertain yourself without spending

- Clean and declutter your house (it’s hard to stay home in a messy house, and you’ll be home a lot when you can’t spend money)

In general, have an idea of what you’ll do instead of spending money on entertainment and luxuries if it comes up.

🌟 Related: The Real Reason You Shop So Much 🌟

What to eat during your no spend challenge

While it’s hard to stop spending money, it can also be a little bit of an adventure. This can also be a great opportunity to try cooking new things.

Go through your pantry and see what you can make with what’s on hand. Have a list of flexible foods to make that don’t require a recipe and can be thrown together with what you have.

Here are some great ideas to get you started:

Breakfast: oatmeal, eggs, toast, fruits, and veggies

Lunch: sandwiches, soups, and salads

Dinner: spaghetti, rice dishes, soups

Most people say that the best frugal habit they develop during this month is eating all their leftovers.

(You might lose a few pounds too.)

Curing the boredom blues

A strange thing about a no-spend challenge is that at first, it’s exciting. For the first day or so, you won’t be bored. Honestly. But what happens when the novelty wears off?

A lot of us go shopping for one reason: good old-fashioned boredom. And when the ability to spend money is taken away, you might find yourself having to confront how truly bored you really are.

Boredom is your cue to try something new. The good news? There are plenty of things to do in the world that are FREE and new to you.

Some ideas:

- -hiking

- -visit a public museum

- -sketch or paint something (look up a Youtube tutorial)

- -go on a bike ride

Staying motivated (focus on the future)

It’s easy to get really discouraged during a no-spend month. You may find yourself wondering why you ever thought this was a good idea.

Here are some things to keep in mind:

- Stay focused on why you are doing this. Hang up a picture of what you’re saving for.

- Your life and your budget will be better after the month is over.

- Think about how free you’ll feel once you’ve saved that money.

- The no-spend month isn’t forever. It’s just thirty days.

Keep going.

Tips for success

- Pack snacks and drinks when you go out.

- Stay BUSY! Clean the house, go for a long walk, do some yard work.

- Don’t spend time around people, advertising, or locations that make you want to spend money

- Remember, you can still be social! Invite friends over for a homemade snack and a board game. There is plenty of free fun in the world.

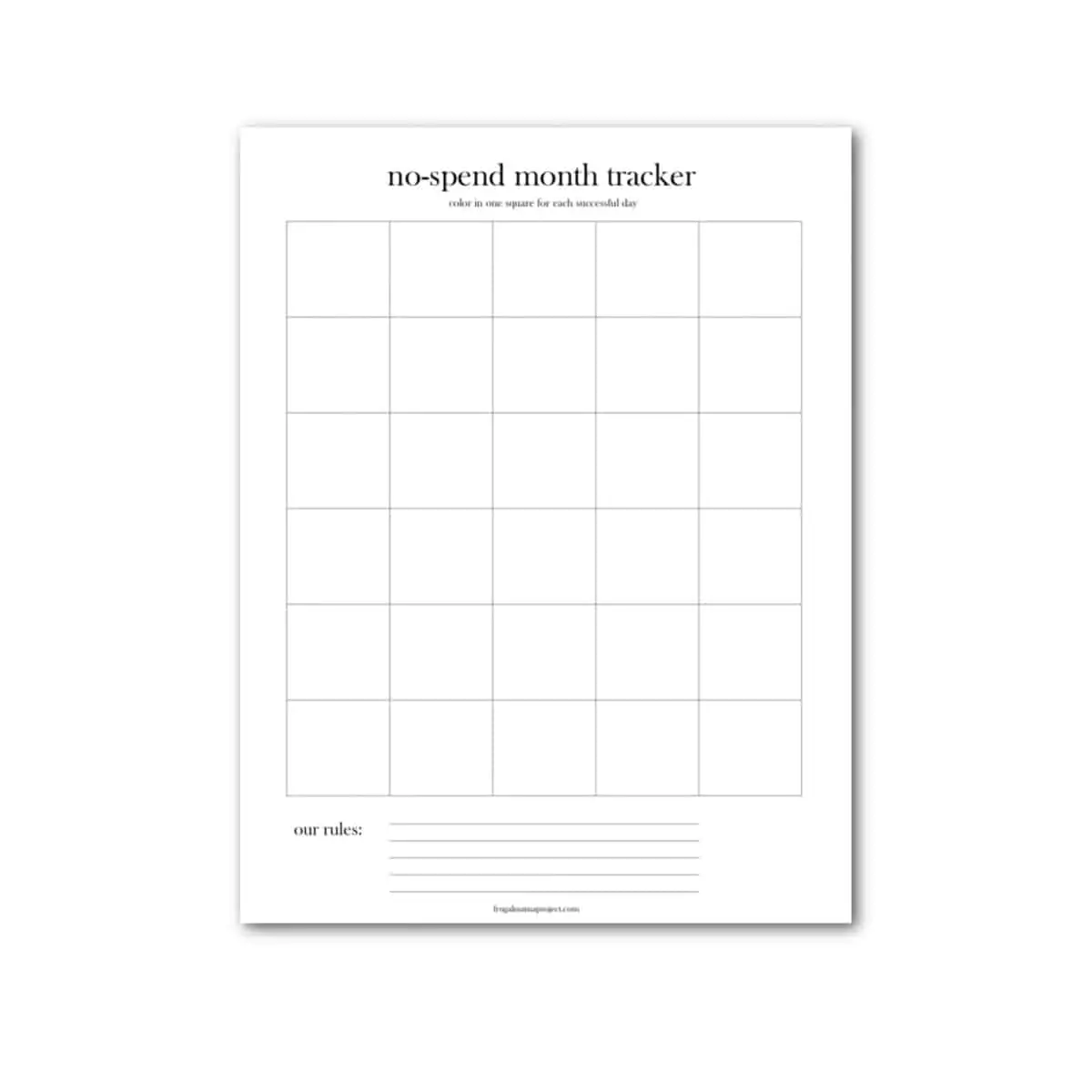

- Make (or print out) a no-spend challenge tracker to stay motivated.

What if I mess up and spend money?

That’s okay! Almost everyone does. Don’t beat yourself up; just stay focused on being frugal in the future.

Most importantly, keep going. Like a diet, one mistake is not a big deal. But if you use it as an excuse to give up totally, it’s a problem.

Printable no-spend tracker

Keep track of your success with this free printable tracker. It’s strangely motivating to see it on the wall and check the days off. It’s a simple, practical design that I hope you’ll print and use.

Click here or on the image below to get your own copy, hassle-free.

What to do when your no spend challenge ends

The common advice is to celebrate with something nice: dinner at your favorite restaurant or taking a trip somewhere when you finish your no-spend challenge.

I hate this advice. Frugal (even extremely frugal) living is not a punishment or something to be afraid of.

If you did this to save for something big, then that’s your reward.

If you did this as a reset or a jumpstart into a new lifestyle, don’t rush to undo it now.Just take away the “rules” and spend in a way that feels good to you. You’ll notice that you naturally want and spend less.

🌟 Now, focus on setting up a long-term budget. My favorite method is zero-based budgeting, which you can read more about here. 🌟

My first no-spend month

The first no-spend challenge I ever did was when I was trying to convince my husband I didn’t have to go back to work after our first baby was born. I wanted to prove that we could dramatically change our finances if we could spend less and that our income wasn’t all that important.

I intended to do this basically forever. This was not possible. But it definitely changed how I looked at my money.

Looking back at our spending habits, we realized that when we were feeling stressed, the first place we would spend gobs of money is on dining out and alcohol. We would go out to eat and drink several times a week, whether out of boredom or stress, or social obligations.

We spend a lot of money at home improvement stores, planning a little project every weekend.

The most surprising thing we noticed was how much money we spent at the movies- going once or twice a month, sometimes more.

But during the month we spent no money at all on these items. We spent a few dollars on groceries, and we ate dinner with each other at home every night—no home spending. No movies.

And honestly? It was fine.

It got us out of yucky spending habits that we didn’t even really enjoy but just did every single weekend out of boredom.

(On the second-to-last day of my no-spend challenge, I was so tired of cooking that we ate ice cream for dinner. This taught me that if you don’t feel like making dinner, you don’t have to go out to eat; you can just serve leftovers. It’s a lesson I still use to this day.)

Ultimately, our no spend month taught me that a huge part of our life was a luxury and that cutting way back on what we spend was totally possible.

A no-spend month is the single best way to reset your budget and take a fresh look at where you’re spending money. It helps you save money, but more importantly, reset your expectations about what you need in life.

It’s easy to read about saving money. Maybe you even take some easy advice, like calling your credit card company for better rates. But when you’re ready to do something, really do something, to help your bank account, a no-spend challenge should be your first step.